Lithium market to see growing structural imbalance through Q4

Forecasts, futures and inventories

With hundreds of companies onboarded since launching our new EV Battery Lithium Monthly intelligence service in February, we are thrilled to announce the addition of several new features in April:

Near-term supply / demand forecasts: Our supply/demand models correlate oversupplied conditions in late-2023 with observed price pressure. We see a reverse to strong deficits from Q3 2024 due to seasonal demand pull, which fundamentally, should see prices rise in this timeframe.

Supply chain inventory analysis: Although China’s lithium inventories have now normalized, cathode stores are at particularly low levels which may precipitate further buying pressure.

Analysis of lithium futures markets: Our look into the growing futures markets in Guangzhou and Chicago depicts a period of indecisiveness as the market awaits the next directional catalyst.

The information below was extracted from the April update of the EV Battery Lithium Monthly service.

Supply outlook robust despite low prices, cuts and delays

Our near-term supply forecast (which includes existing producers plus projects permitted, funded and under construction) incorporates the latest supply cuts and project delays.

Through Q4 2025, expected growth in mined supply remains robust despite subdued spot lithium prices. This is largely due to advanced brownfield expansions and the ramping of greenfield projects put into construction in 2022/2023.

Demand emboldened by 2023 momentum, building into 2024

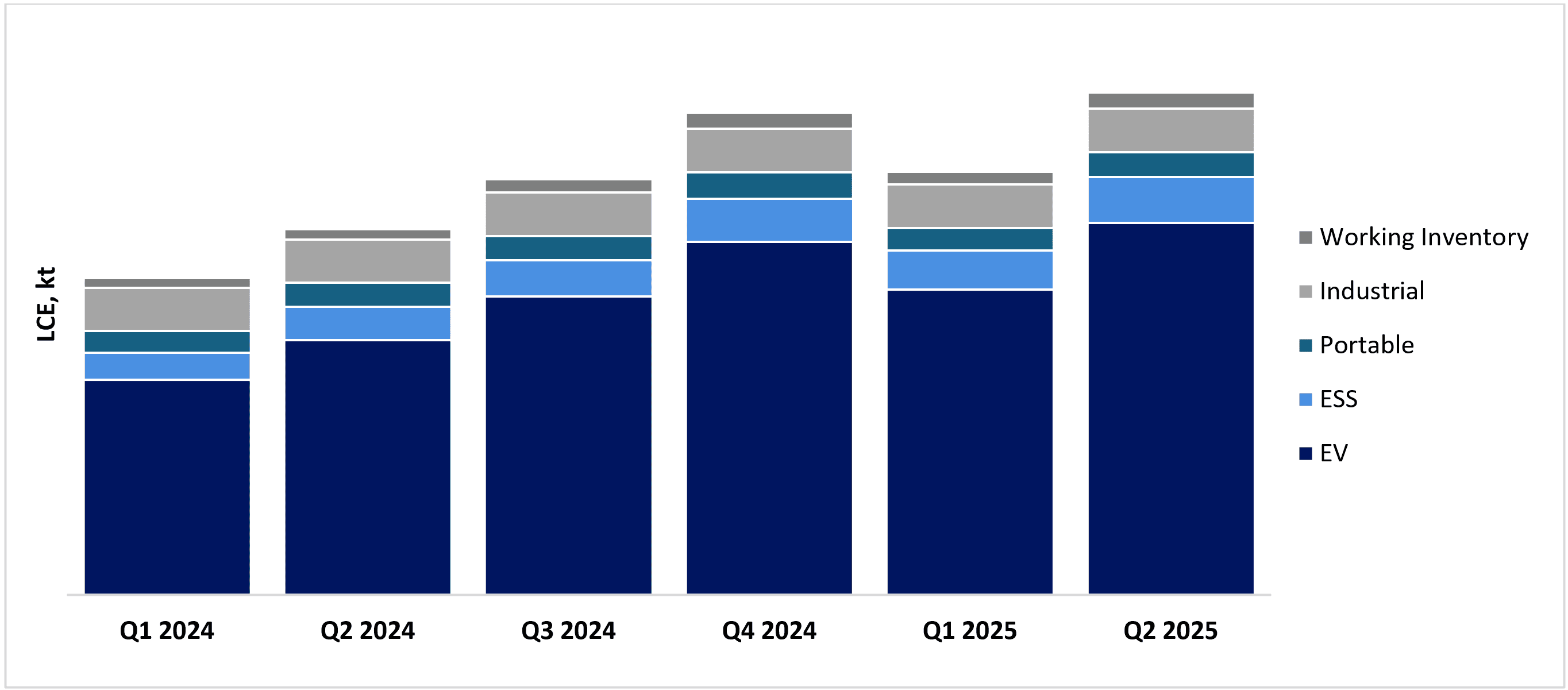

As the market exits a seasonally muted period of industrial activity and consumer spending, LCE demand is expected to rebound in Q2 2024, building on a strong base established in 2023.

Led by a projected 40% rise in passenger EV sales this year (including HEVs) and a 6% rise in average pack capacity, we expect a 48% increase in LCE demand from the sector in 2024.

Surplus in Q1 2024, growing deficits expected thereafter

To reconcile mined supply to deployed lithium, we assume a 6-month lag between production and end-use consumption, analogous to real world transient effects.

Our analysis expects a small structural deficit in Q2 2024, growing to more pronounced volumes in Q3 and Q4 as end-user demand ramps up, fueling the drawdown of LCE inventories and an expected resumption of buying pressure in H2 2024.

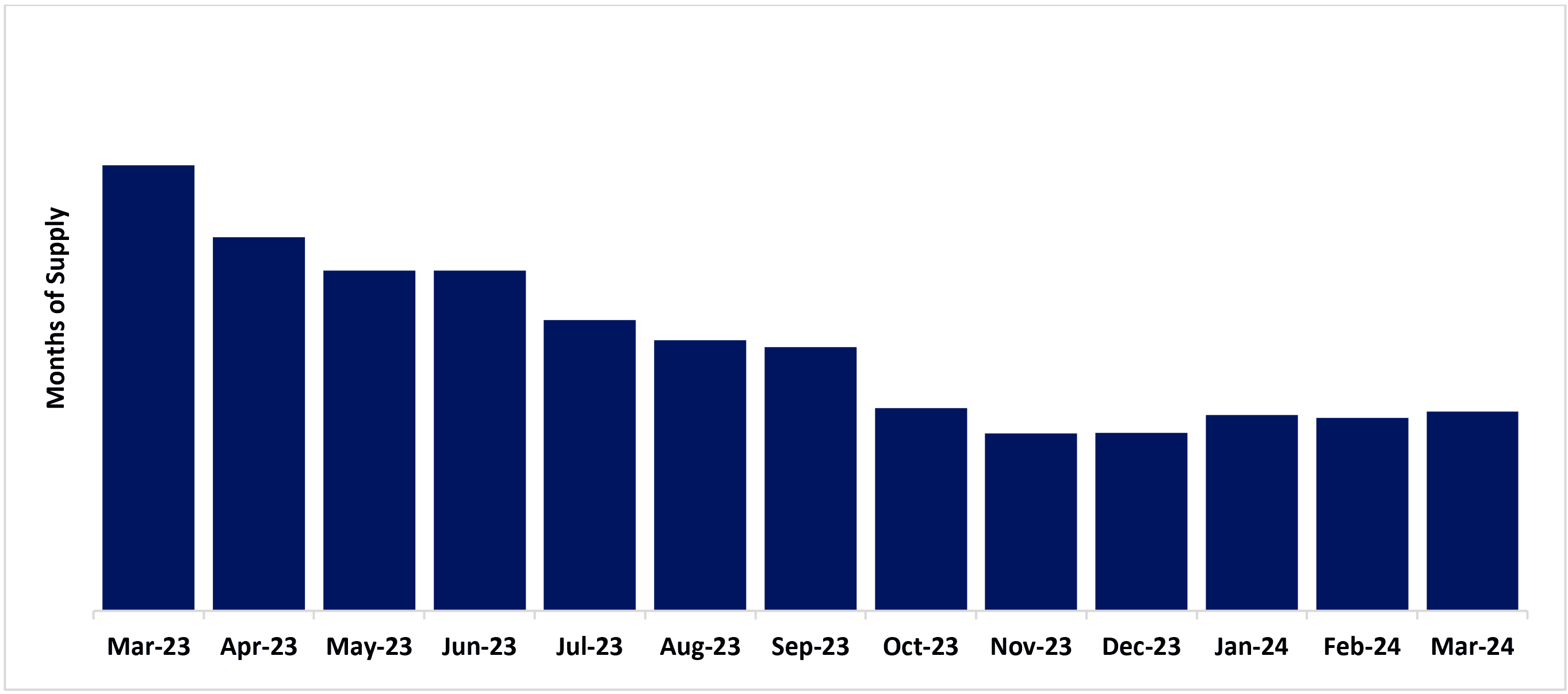

Inventories normalizing at historical normal levels

In March 2024, China’s supply chain held an estimated 1.7 months of LCE supply, unchanged since the start of the year and within the 1–2-month range widely viewed as a typical working inventory.

The rapid destocking of 2023 appears to have concluded in the first quarter of 2024 and, in aggregate, we do not expect any major restocking through the end of Q2.

However, with cathode stocks at historically low levels and a growing structural deficit of mine supply expected from Q2 through Q4, we anticipate salt inventories will be pulled through, adding support for sustained higher prices upstream in the second half of the year.

Note: Clients can access detailed supply / demand forecasts and fully labelled charts and tables through the EV Battery Lithium Monthly intelligence service.