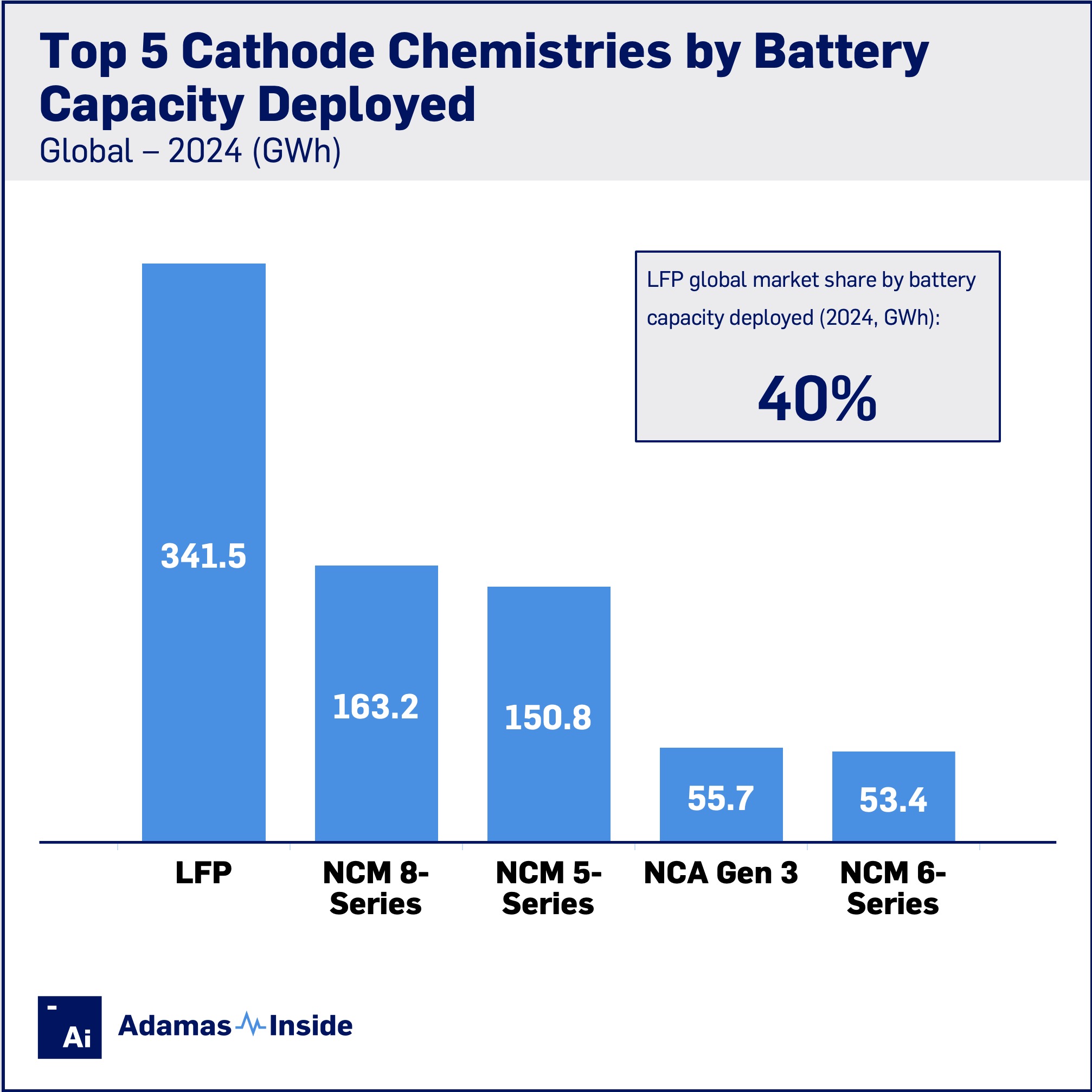

LFP now commands 40% of the global EV battery market

In 2024, 864.0 GWh of battery capacity were deployed onto roads globally in all newly sold passenger EVs combined (including plug-in, range extender and conventional hybrids), up 25% over calendar 2023.

EVs sold last year fitted with LFP packs added a whopping 341.5 GWh to the global EV parc, a 53% jump over the year before. LFP cathodes now command 40% of the market in GWh terms, up from 32% in 2023.

LFP’s accelerating adoption came mostly on the back of Chinese automakers with the cathode chemistry representing 58% of the combined battery capacity of EVs made in-country and sold worldwide last year. On a quarterly basis LFP’s share of EV sold in China has been above 50% since Q4 2022 and in the final quarter of 2024, that number rose to 64%.

In contrast, on the US market deployment of these nickel, cobalt and manganese free batteries has been shrinking, hitting a new low of just 5% of the total GWh hitting American highways and byways in Q4 last year. This was mostly due to sales of LFP-powered Tesla Model 3s entering the slow lane.

Worldwide battery packs in the NCM 8-Series (roughly 80% nickel content) claimed a distant second at 163.2 GWh after a 20% expansion year over year. The long-running trend towards high-nickel NCM chemistries weakened in 2024 and the use of high nickel batteries grew at a slower pace than that of NCM 5-Series packs. Both NCM 6 and 7-Series deployment declined by single digit percentage points last year.

The battery capacity of EVs sporting mid-nickel cathodes sold last year rose by 13% to 150.8 GWh. With the raw material cost differential to LFP narrowing as nickel and cobalt prices hover near multi-year lows, NCM 5-Series battery packs have remained popular among Chinese automakers for their more upmarket offerings.

The total capacity of EVs sold in 2024 equipped with third generation NCA batteries slipped by 14% to 55.7 GWh after a decline in deployment in Tesla vehicles equipped with Panasonic packs. The Japanese battery maker and Samsung SDI each owns half the NCA market, but unlike Tesla, customers of the Korean company’s packs, particularly BMW, experienced an outstanding 2024.

A striking feature of the 2024 EV battery market was the rise of NCMA packs supplied by Ultium Cells (a partnership between General Motors and LG Energy Solution) and LGES separately. GM’s success with the Chevrolet Equinox, Cadillac Lyriq and the Honda Prologue it builds on behalf of the Japanese carmaker helped adoption of NCMA chemistries surge nearly nine-fold to 19.9 GWh year over year.

Contact the Adamas team to learn more or check out the intelligence services below.