The 1,300 mile range, $14,000 Chinese EV you won’t get in the US

New York to Miami

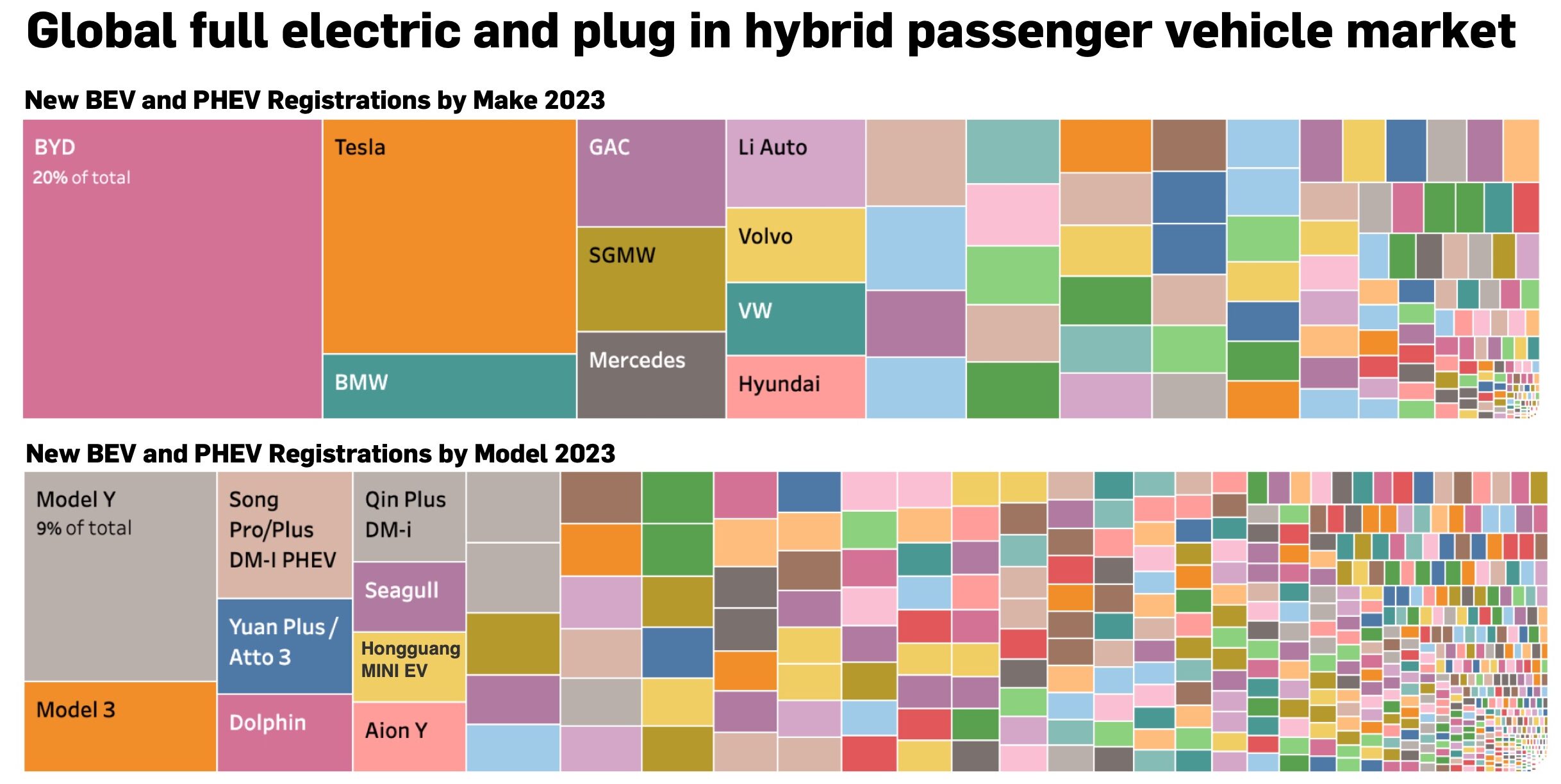

BYD, the world’s top electric passenger vehicle maker by volume, this week unveiled two new plug-in hybrid (PHEV) models with an eye-popping range of 1,300 miles (2,100 kilometers).

That’s enough to do a trip without recharging or refueling from Washington via New York to Montreal – and back. Or New York to Miami one way.

What’s more, Shenzhen-based BYD is pricing the two new sedans, which pair a 1.5-liter engine with an under 16-kWh lithium iron phosphate (LFP) battery, under the magical 100,000 yuan level, or less than $14,000.

BYD, which is also the number two EV cell and motor supplier globally, earlier this year also cut the price of its Seagull compact hatch BEV to under the equivalent of $10,000 a pop.

Back door

Faced with stiff competition and paper thin margins in China, BYD is keen to roll into new markets.

While the Buffet-backed company is streets ahead of the competition in its home market, capturing 29% of all sales last year, the company has made no inroads into the US and is largely absent from the Americas in general, except for Brazil where some 6,400 of its EVs found buyers last year.

But, as it stands today, it’s unlikely that US and Canadian buyers will ever be able to purchase the new Qin and Seal PHEVs, and across the Atlantic, those BYD models that do arrive in Europe are almost certain to be priced far above what they are in China.

Stella Li, executive vice president of BYD and CEO of BYD Americas, said in February the company is “not planning to come to the US” adding that “it’s an interesting market, but it is very complicated.”

Li also explained that BYD’s plans to set up a factory in Mexico are not aimed at backdoor entry into the US market. The Chinese firm launched its plug-in Shark pick-up truck for the domestic Mexican market earlier this month, a competitor to the Ford F-150, the best-selling vehicle in the US for decades.

Roadblocks

A fortnight ago, the Biden administration quadrupled import tariffs on vehicles made in China, first implemented by the Trump White House in 2017, lifting levies to a whopping 102.5%, effective this year.

Import duties on lithium-ion cells and components from Chinese manufacturers were also increased from 7.5% to 25% effective in 2024. Rare earth permanent magnets, used in the motors of over 90% of EVs sold globally, will also attract an import tax of 25% from 2026.

The UK and Canada are also looking into ways to put up barriers to cheap Chinese EV imports. The anti-dumping probe launched by the European Union last year will be finalized within months and is likely to result in the imposition of trade sanctions or other punitive measures.

BYD vs Tesla

BYD vs Tesla

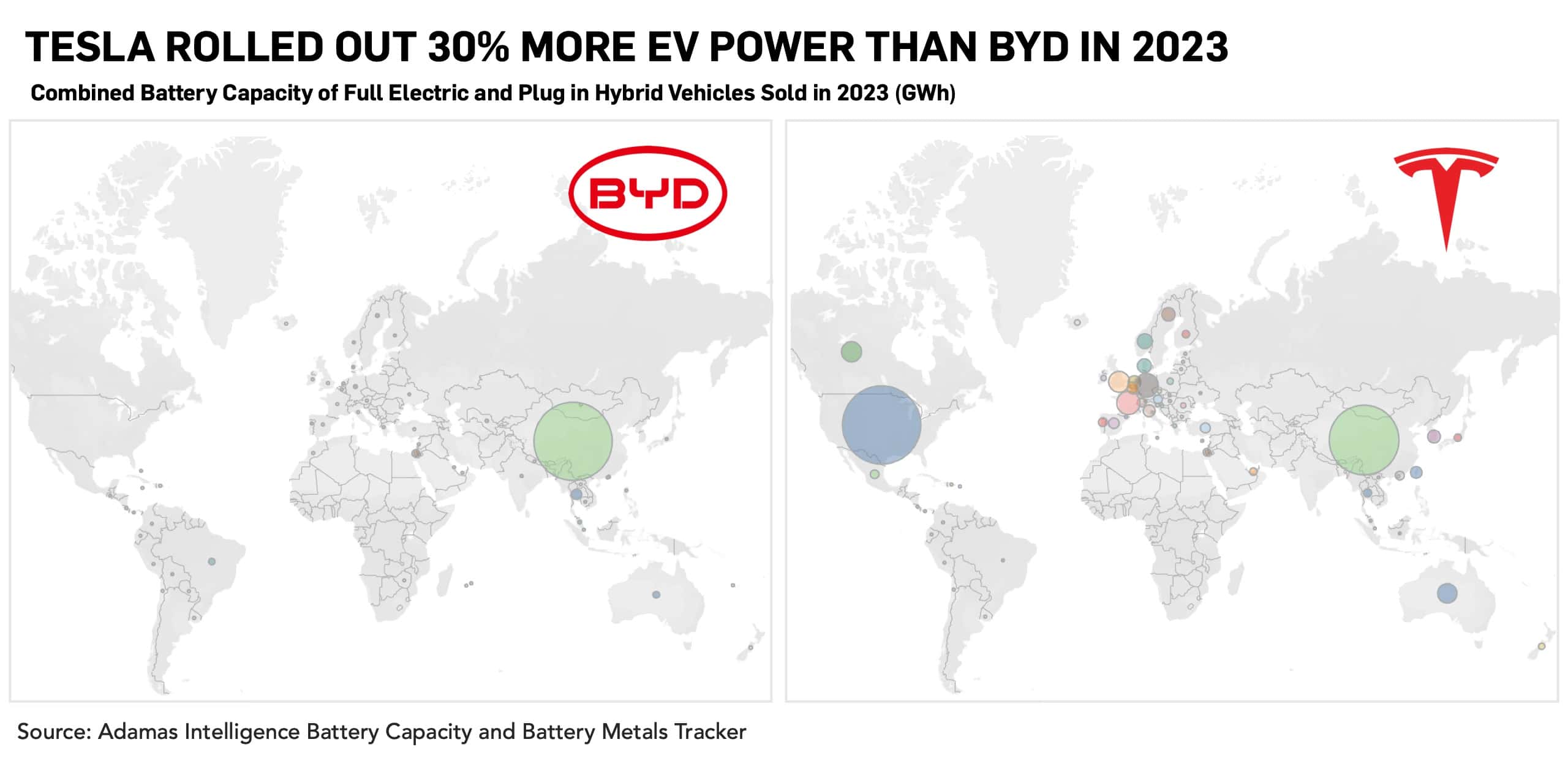

When it comes to market diversification, Tesla is in a much better position than BYD moving just shy of 700,000 units in the Americas, affording the Texas-based company a similar market share in the region to that enjoyed by BYD in China.

In terms of battery capacity rolled onto roads – which creates a fuller picture of the scale of global vehicle electrification than unit sales alone – Tesla remains way out front of BYD.

Tesla supplied 132.1 GWh of pack power to buyers of its S, 3, X, Y models in 2023, a 37% jump compared to 2022. And that’s before the Cybertruck, with its beefy 122 kWh cell pack (and optional 47 kWh range extender), goes full beastmode on the competition.

Over the same period, BYD upped its combined battery capacity deployment by 51% year-over-year to 101.6 GWh, with the gap to Tesla accounted for by the fact that around half of BYD’s sales last year were PHEVs, which have inherently smaller batteries than Tesla’s BEVs.