The Cybertruck is a battery metal beast

Battery day and night

Tesla started deliveries of its much-anticipated Cybertruck late last year and, while reactions to the triangle truck have ranged from ecstatic to dismissive, no-one seems able to ignore the gleaming one-of-a-kind vehicle.

The Cybertruck – only the sixth production vehicle in the Tesla stable – sports the company’s proprietary 4680 cells first revealed at its Battery Day event in 2020.

The 4680 is a large tabless cylindrical cell with a nickel-cobalt-manganese (NCM) cathode. Closer in size to a can of Cola than the 18650 cells of yesteryear, Tesla’s 4680s are already powering the 84.6 kWh performance version of its Model Y assembled in Texas.

The Cybertruck AWD and top of the range Cyberbeast model up that capacity to 122.4 kWh according to Tesla filings with the US EPA, although it’s not clear from the documentation whether this is a total or usable figure. The base RWD version, which is a full $40k cheaper than the Cyberbeast, is not yet available to order.

Buyers can add a range extender to get the truck close to the 500 miles (800kms) of driving range that Elon Musk promised at the now infamous smashed window launch of the Cybertruck back in simpler times – 2019.

The separately installed range extender takes up about a third of the truck’s bed but can supply a extra 47 kWh – a configuration that puts the pickup on the right side of the Biden administration’s generous $7,500 subsidy scheme.

Pre-orderly conduct

There is no firm number on the pre-orders Tesla has received. A crowdsourced tally put it as high as two million while Musk confirmed it is over one million. Given the hype surrounding the Cybertruck, a million-plus fans who only had to put down $100 (now $250) for the privilege does not sound outlandish.

How many Cybertrucks Tesla can produce is also far from being bolted down. Tesla told investors last year the company can produce anywhere between 250,000 and 500,000 units per year, while at least one investment analyst predicted the bottom end of that range and only in 2025.

Split the difference and you get 375,000 Cybertrucks per year, but Musk did admit in December that the Texas plant was in “production hell” and Tesla has a well-earned reputation for overpromising and underdelivering.

Mutatis Mutandas

Irrespective of model-version, Tesla’s triangle truck is a battery metals beast.

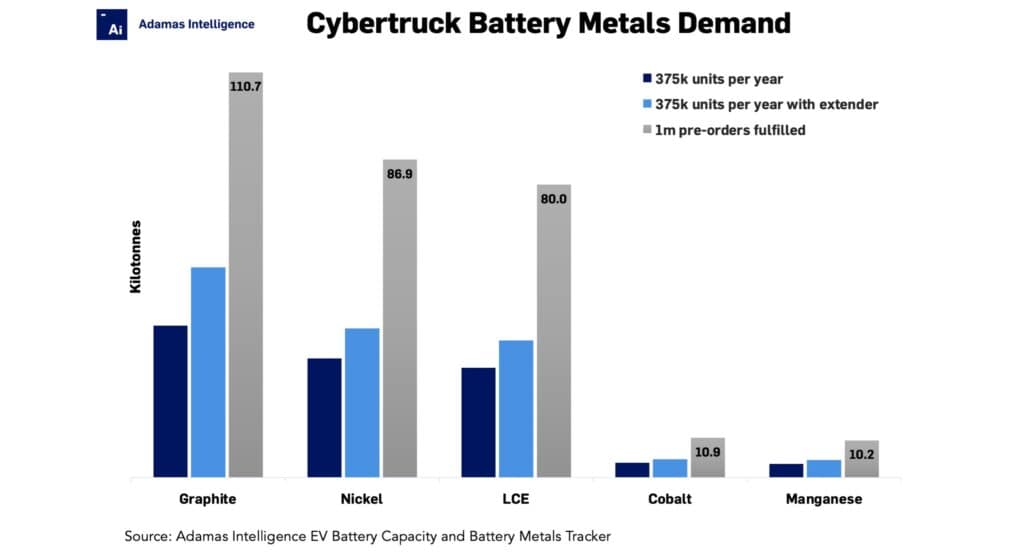

If or when Tesla produces 375,000 Cybertrucks a year the company would need around 41,500 tonnes of graphite, 32,600 tonnes of nickel, 30,000 tonnes of lithium carbonate equivalent, 4,100 tonnes of cobalt and 3,800 tonnes of manganese per annum for finished cells alone.

Take into account yields all the way up the supply chain and those figures begin to look very conservative.

Add in those Cybertruck owners who opt for an extra pack in the back and there’s thousands of tonnes of reasons why Tesla could consider upping its mining investments.

Worldwide, the average nickel mine produces 42,000 tonnes of the devil’s copper per year. Tesla will need full offtake from at least one of them for its truckers (and maybe another for the nickel in the stainless steel body).

Similarly, the output of one average flake graphite mine would also be needed for Tesla to crank out 375,000 pickups per year.

Same goes for cobalt where the average global operation produces around 5,000 tonnes per annum.

When it comes to LCE, the Cybertruck and extender pack assembly lines need some three-quarters of a mid-size brine or hard rock operation’s output each year.

To fulfil a million orders, Tesla could consider buying the world’s second-largest nickel mine, Sorowako. It would need 100% of the Indonesian operation’s yearly output to do so, plus that of the tenth largest nickel producer, Murrin Murrin, in Western Australia.

As for cobalt, Tesla should hope that the output from Mutanda in the Congo does not deteriorate further because to produce a million Cybertrucks, it would need to double the offtake it signed with owner Glencore in 2020 or risk disappointing those who put down the $100 deposit.

With Elon’s production hell currently driving low production and slow deliveries, it appears there is plenty of time to stockpile the materials.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview