Tesla cuts jobs as global market share tops 21%

Market correction

It’s been a dramatic 2024 for Tesla to-date:

The company has seen a sharp fall in the value of its shares – down nearly 40% year-to-date for a market value of $480 billion, $800 billion below its November 2021 peak.

More recently, reports emerged that the Texas-based company is shelving plans for its mass market sub-$30,000 vehicle, which it has since denied while simultaneously announcing it would launch a self-driving taxi as early as August.

However, this week brought the most stunning news yet. Tesla plans to lay off at least 10% or potentially over 14,000 of its employees as first reported by Electrek.

At the same time, two prominent executives announced their departures, including the vice-president who oversaw the development of Tesla’s own batteries.

Power play

While Tesla’s stock has drifted into choppy waters this year, the now 20-year old company’s command of the global electric car market remains undeniable.

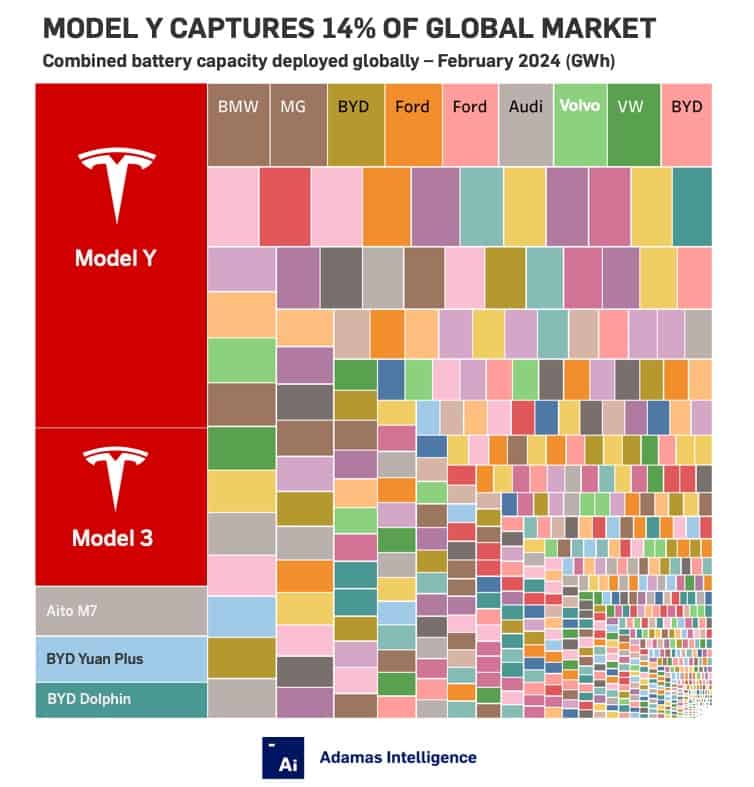

Adamas Intelligence data shows that no other company – and that includes BYD – comes close to the scale of Tesla in terms of its contribution to the electrification of the global car parc.

To produce the most accurate and granular results, Adamas Intelligence data is based on end-user vehicle registrations (i.e., wheels on roads) and not extrapolations of production figures or wholesale trade to dealers.

When tabulating battery capacity deployed, which provides a fuller picture of an automakers’ EV penetration than unit sales alone, Tesla was the clear world number one in 2023, delivering 132.1 GWh of battery capacity to buyers of its S, 3, X, Y and Cybertruck models, a 37% jump over 2022.

To much acclaim, BYD has been the world’s top EV unit producer since 2022 (excluding HEVs) thanks to a sales mix that is almost half plug-in hybrid, but with 101.6 GWh deployed last year, BYD still lagged well behind Tesla when it came to powering up new buyers of its vehicles.

Strong start

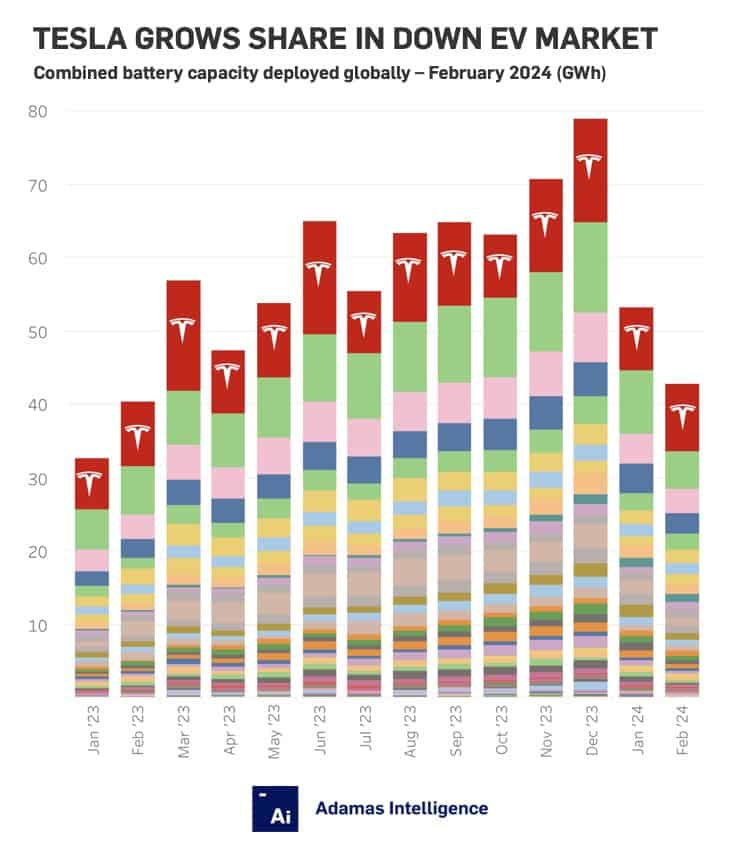

Into the new year and Tesla is showing some momentum while BYD’s furious start to 2024 came to a screeching halt in February as China all but shut down for the Lunar New Year holiday.

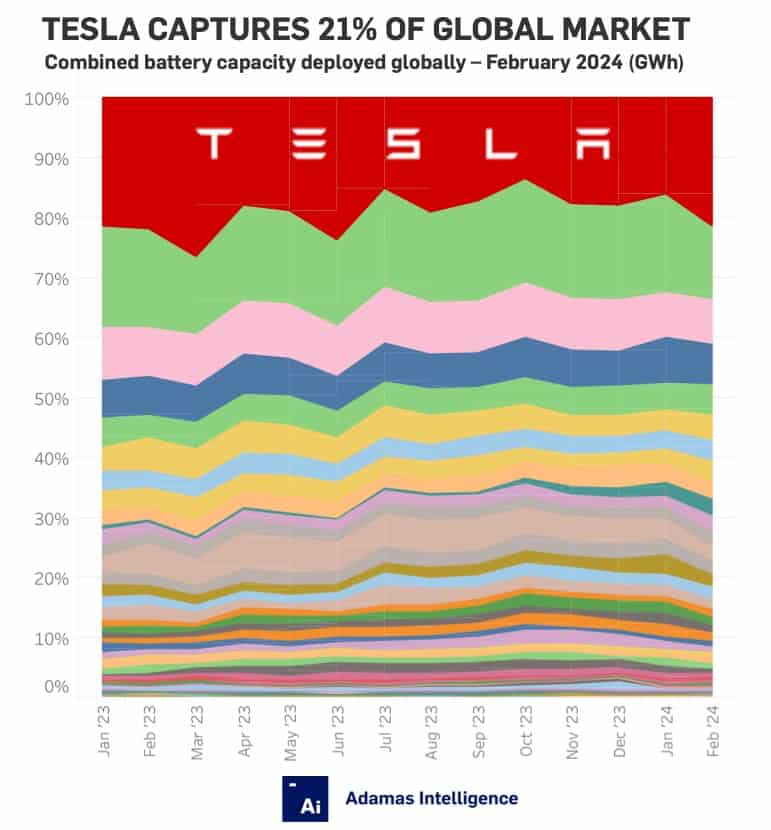

The combined battery capacity of all Teslas sold in February (now including the Cybertruck, with its beefy 122 kWh pack) totaled 9.2 GWh, topping 21% of the global total, or 1 out of every 5 kWhs rolled onto roads for the first time that month.

In February, Tesla’s battery capacity deployment rose more than 7% month-over-month and 4% compared to February of last year, while that of BYD fell 41% month-over-month and 22% year-over-year.

Indeed, among the top 10 automakers globally, it was only Tesla and Stellantis, owner of Jeep, Citroen, Fiat, Chrysler and other notable brands, that experienced growth from January to February.

Away game

Even in the Chinese market, Tesla had a better month than BYD, which, despite launching an all out price war in its home market, suffered a 42% month-on-month and 31% year-on-year drop in battery capacity deployed at home in February.

Tesla not only outperformed BYD on its home turf, but also the overall Chinese market, which was 11% smaller in February 2024 than the same month last year and shrunk 41% compared to January – thanks primarily to a Chinese holiday lull.

New Tesla drivers in China rolled 2.0 GWh onto the country’s roads in February, down 25% compared to January and 12% compared to last year. The Model Y was the top model in China in February, capturing 8% of the market in GWh terms.

Tesla’s own Texas-made cells, which are fitted to the Model Y and Cybertruck, also took away market share from rivals in February, capturing 2% of the global market with 0.7 GWh rolled onto roads.

That was up 13% compared to January and a 33% jump over February 2023 versus a 35% and 10% decline for BYD’s cell deployment, respectively, which apart from use in its own models are also supplied to a handful of outside customers, including Toyota.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview